TTB Reporting Made Easy

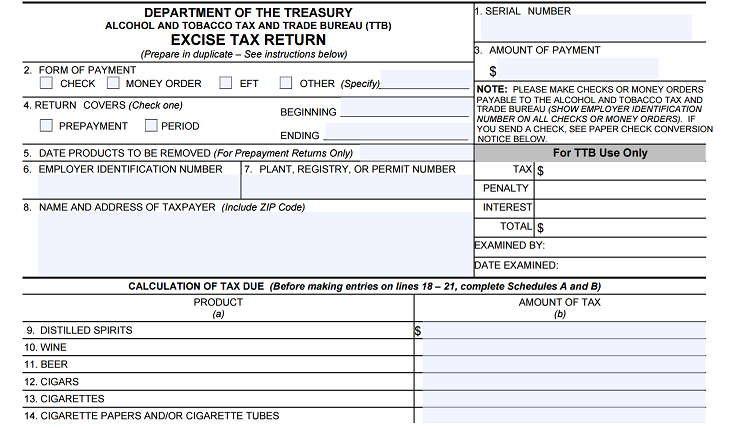

The Alcohol and Tobacco Tax and Trade Bureau claims that more than 50% of TTB reports filed by US breweries are submitted with errors that require correction on the brewery’s part. The general consensus indicates that the cause of most errors on the Brewers Report of Operations (BROP) stem from issues around general record-keeping, different interpretations of production stages, or not fully understanding where on the form to document specific production activities that occur during the brewing process (taproom transfers, marketing samples, loss, QC testing, etc.).

With VicinityBrew populating your TTB BROP, it’s as easy as selecting the date range and hitting refresh!

We use a system of “reason codes” that will auto map inventory transactions to whichever line you choose; marketing samples, donations, taproom transfers, destroyed WIP, etc., will auto map to the appropriate line on the TTB BROP.

Improving Overall Record-Keeping with Brewery Management Software

Without a centralized database, most breweries operate having each department maintaining their own “systems of record,” such as word documents, excel spreadsheets, and even email or paper. It’s standalone tools like these that create the discrepancies within the brewery organization that most often result in the variations of the operational truth. Inconsistencies across departments introduce more questions than answers when it comes to reporting, and thus creates the need to double manually, or even triple check information to find out which of these records reflect the brewing reality.

Where Do You Go to Answer the Following Questions?

What line do I put donated beer on and how do I get it there automatically?

When I transfer beer to the taproom, what line should it go on?

What amount of barrelage was sent to QC for testing?

What % or amount of beer was spent in QC testing?

If I have to dump a tank, what line does it go to?

What was our actual yield or loss on production from X to Y date?

Having one system to encompass this information saves you time in both finding the data as well as validating it.

For example:

You will tag items with attributes such as “produced by fermentation” and that automatically maps brite beer to line 2, “Beer produced by Fermentation” so all you have to do is post a fermentation log and it will auto-populate the line. Also, a pack size attribute (12 oz, 19.2 oz, 1/2 BBL, 1/6 BBL, etc.) will map your finished goods to the proper line and column…no more separating out kegs from cases MANUALLY.

Our Vicinity team works with you so every line populates automatically where you need it to be. We are happy to walk you through the entire process, answering questions along the way. We know that every brewery may do something a little bit different and we work with your team one-on-one to map items where you need them. Gathering info and submitting your TTB report (monthly or quarterly) has never been easier.

Better Safe Than Sorry, Leaving Cash on the Table.

Rather than risk failing an audit, many breweries prepay tax on all beer produced regardless of where it ends up. Being able to track production while adequately identifying and tagging the amount of beer attributed to loss or consumed for quality analysis can save you money in the long run, but more than saving money you get a complete record of production history and activity.

Having a brewery management solution like VicinityBrew will help you solve many of the issues surrounding “general record-keeping ” items identified, such as required signatures, properly maintaining records, and having an adequate report of shortages and losses supported by the physical inventory counts.

Variations in Process, to Variations in Reporting

From brewery to brewery, coast to coast, everyone operates their business a little bit differently, and the way they file their BROP is no exception. Misinterpretations of definitions between different beer stages will directly impact what you should be reporting. Determining where in the form, or on which reporting line, a piece of information such as loss or theft belongs, can also be confusing in certain circumstances. As the craft beer industry has evolved, so have the BRO line interpretations. In some cases, those completing the form have one idea of how the form should be filled out, using their data source of course, while the individuals who review the document have a different understanding, and data source.

Confirming with your TTB representative on how they will be reviewing your submission to support consistent processes in reporting is a great way to avoid getting in any hot water. Simply put, your primary concern should be meeting the expectation of your TTB representative.

If you’d like more information or are ready to get started, contact us today!